Campaign

CT Global Multi-Asset Income

Seeking a consistent income from bricks and mortar?

Consistent, sustainable income with less volatility than an equity strategy

A long-only, dynamically managed multi-asset fund that targets an attractive, sustainable level of income while aiming to preserve and grow capital over the medium-to-long term.

Flexibility and active management lies behind the fund’s approach, as it seeks to provide a yield pick-up over traditional bonds without the volatility of an equity-only income strategy.

In a market where yields across many asset classes are low, our Global Multi-Asset Income Fund provides a cost-effective solution for investors seeking a good level of income whilst keeping volatility in check.

*Ratings as at 31.12.2018. Citywire rating is for absolute return

Overview

Targets attractive, sustainable income

Invests in high-yielding, higher-quality equity, fixed income and property securities without necessarily increasing the risk of capital depreciation over the longer term

Diversification and risk focus

A well-diversified portfolio, investing across equities, fixed income and property enables the team to adapt our approach depending on prevailing economic conditions

Straightforward, transparent strategy

An unlevered, long-only, dynamically managed approach to income

Heritage in asset allocation

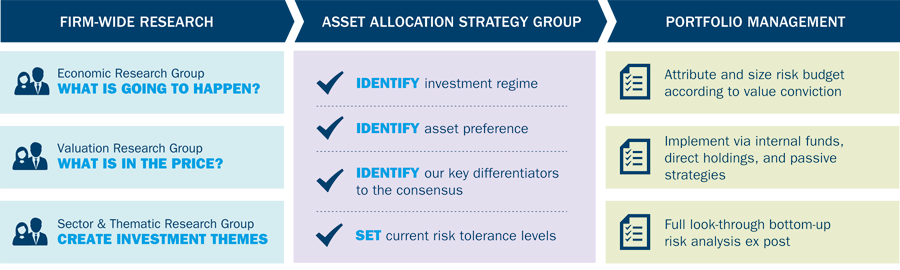

A long track record of managing multi-asset strategies with a dedicated multi-asset team of more than 20 investment experts, including an eight strong Asset Allocation Strategy group

Key facts

- Launch date

31 July 2014 - Comparator Benchmark

UK IA – Mixed Investment 20-60% Shares - Asset class weightings

Equities: 20-75%

Fixed income: 20-70%

Cash: 0-10%

Combined Cash and Income: 30-80%

Property: 0-30%

Filter insights on this page

Capabilities

Media type

Themes

Regions

Process

A collaborative and risk-orientated approach

Objective

The aim of the Fund is to provide income with the potential to grow the amount you invested over the medium to long term.

The Fund will invest at least two-thirds of its assets so as to gain global exposure to company shares, bonds (which are similar to a loan and pay a fixed or variable interest rate) and property. The amount of the Fund that is invested in the different asset types will vary over time as the Fund seeks to achieve its aim.

The Fund will invest in shares and bonds indirectly through regulated and unregulated funds. The Fund may also invest in these assets directly or indirectly by using derivatives. Derivatives are sophisticated investment instruments linked to the rise and fall of the price of other assets.

The Fund’s exposure to commodities and property will be gained indirectly through other funds, related securities, or by using derivatives. Commodities are physical materials such as oil, agricultural products, and metals.

Other Information:

The following benchmarks are currently used as a point of reference against which the Fund’s performance may be compared: Peer Group: Many funds sold in the UK are grouped into sectors by the Investment Association (the trade body that represents UK investment managers), to facilitate comparison between funds with broadly similar characteristics (peer groups). This Fund is currently included in the IA Mixed Investment 20-60% Sharers sector. Index: A composite index comprised of 40% MSCI World Index, 40% Bloomberg Barclays Global Aggregate (Hedged to GBP) Index and 20% MSCI UK Monthly Property Index is currently considered to provide a suitably weighted performance measure of global equities, global investment grade bonds (hedged to sterling) and directly held UK property respectively.

Fund Manager

Toby Nangle joined the company in 2012 and is currently Head of Multi Asset & Head of Global Asset Allocation, EMEA. In this role he is responsible for managing and co-managing a range of multi-asset portfolios, as well as providing strategic and tactical input to the company’s asset allocation process. Before joining the company, Toby worked at Baring Asset Management, initially in the fixed income team and subsequently as Director of the Multi-Asset Group. He holds degrees in History and International Relations from the University of Cambridge.

Contact details

Contact our Sales Support

Contact our regional sales team