Campaign

CT (Lux) Global Focus

Reasons to invest

Differentiated investment approach

A clear and consistent quality approach focusing on competitive advantage to deliver strong, sustainable returns.

Accesses the best global ideas

Freedom to invest without constraints across regions, sectors and market capitalisation, accessing both developed and emerging markets.

Strength in research

Global research capabilities and bottom-up stock picking drive high-conviction portfolio holdings.

Risks to be aware of

This fund is suitable for investors who can tolerate higher levels of risk and volatility in return for higher returns over a long-term investment horizon. Investors could lose some or all their capital and should read the Prospectus for a full description of all risks. Investment risks: Investment in equities, portfolio concentration and currencies.

Investment approach

Insights

On your bike - Shimano and cycling

Water in crisis – searching for solutions

In search of sustainability – following Highway 101

Fund Manager

David Dudding joined the company as an equity research analyst in 1999. He has managed the Threadneedle (Lux) Global Focus Fund since 2013 and the Threadneedle European Select Fund since 2008.

David previously worked for John Swire and Sons in Hong Kong and for Investors Chronicle as a financial journalist.

He holds a bachelor's degree in Modern History and a master's degree in European Politics from Oxford University. He also holds the Chartered Financial Analyst designation and is a member of the CFA Society of the UK.

Important information: Your capital is at risk. Columbia Threadneedle (Lux I) is a Luxembourg domiciled investment company with variable capital (“SICAV”), managed by Threadneedle Management Luxembourg S.A. This material should not be considered as an offer, solicitation, advice or an investment recommendation. This communication is valid at the date of publication and may be subject to change without notice. The SICAV´s current Prospectus and the summary of investor rights are available in English and/ or in local languages (where applicable) from the Management Company Threadneedle Management Luxembourg S.A., International Financial Data Services (Luxembourg) S.A., your financial advisor and/or on our website http://www.columbiathreadneedle.com. Threadneedle Management Luxembourg S.A. may decide to terminate the arrangements made for the marketing of the SICAV.

In the Middle East: The information contained on this website is provided by Columbia Threadneedle Investments (ME) Limited, (CTIME), on behalf of Threadneedle Management Luxembourg S.A. CTIME is regulated by the Dubai Financial Services Authority (DFSA). The information is for intermediaries only to provide information about group products and services. It is not intended for any other Persons.

You may also like

About Us

Millions of people around the world rely on Columbia Threadneedle Investments to manage their money. We look after investments for individual investors, financial advisers and wealth managers, as well as insurance firms, pension funds and other institutions.

Our funds

Columbia Threadneedle Investments has a comprehensive range of investment funds catering for a broad range of objectives.

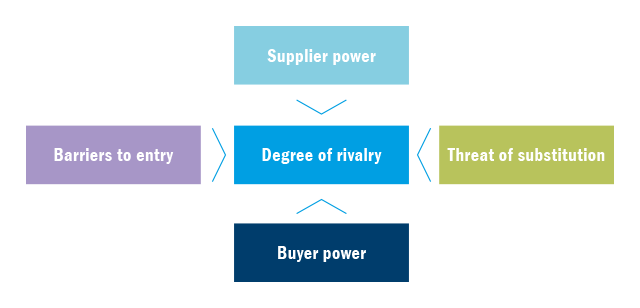

Investment Approach

Teamwork defines us and is fundamental to our investment process, which is structured to facilitate the generation, assessment and implementation of good, strong investment ideas for our portfolios.