At the end of 2021, with the coronavirus racing back on to the stage for an unexpected encore, global audiences were increasingly looking to treat it as background noise – but transitions can be tricky. Inflation in major economies has recently hit levels not seen for 10 years, and the world is finally waking up to the stark choices presented by the climate emergency. Although we expect the coming years to see the reappearance of many elements of pre-pandemic economic life, this is not a return to the “old normal”.

In this paper we set out our expectations for what this could mean for investors over the next five years and in the long run; these capital market assumptions form the base case we use when constructing strategic asset allocations for our clients. We also highlight some key uncertainties, which also form part of our portfolio construction process.

Return drivers

Over the long term we believe asset class returns are driven by their exposure to fundamental macroeconomic risk factors. These include broad economic growth and inflation, as well as the premia that investors demand for bearing market-related risks such as illiquidity, providing long-term funding and a lack of investment transparency. In the medium term, changes in market valuations are an important additional source of return.

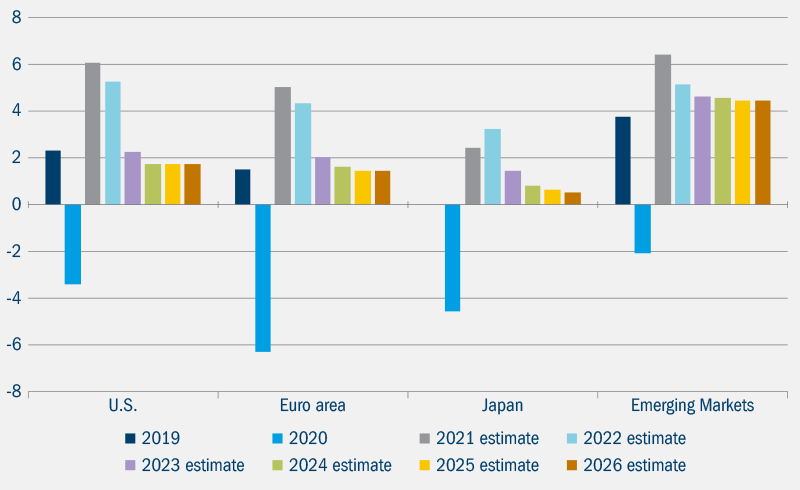

GDP Growth (%)

Source: IMF, as at October 2021.

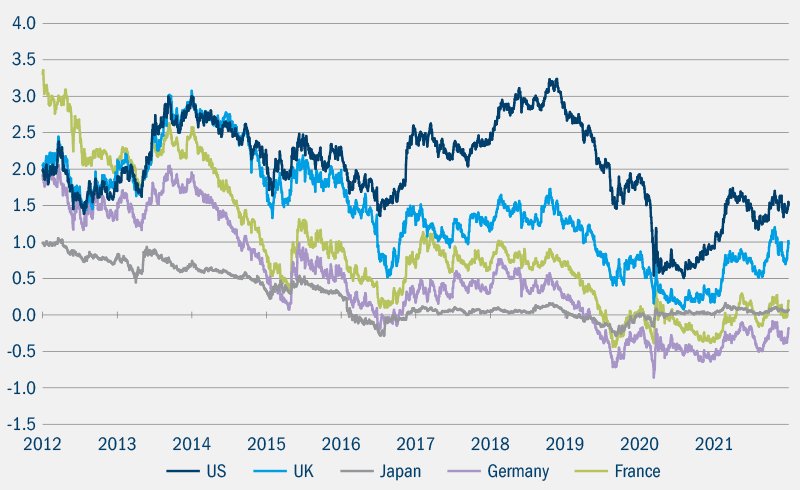

Government 10-year bond yields (%)

It is not possible to invest directly in an index.

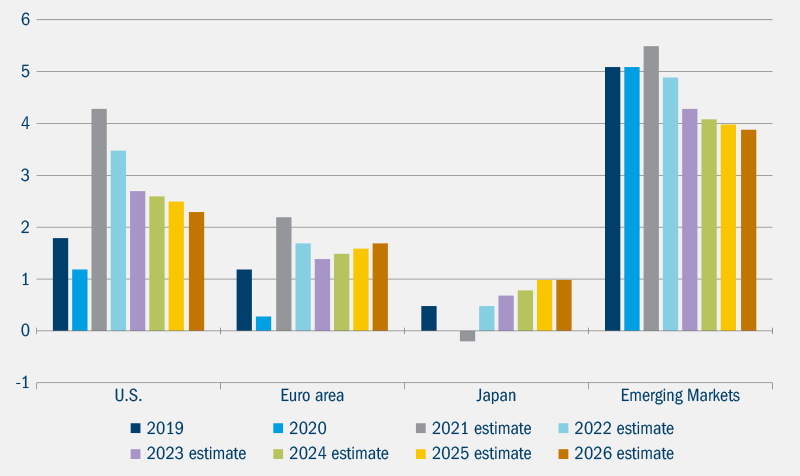

2021 was a period of very strong returns in markets, with growth in part fuelled by significant support from monetary and fiscal policy. But the immediate crisis of the pandemic is coming to an end in many places and inflation has begun to pick up. While some of this is a “base effect” – ie, the result of comparing prices with their lows experienced during the pandemic – there have been real difficulties faced by supply chains struggling to cope with renewed demand. We therefore foresee reductions in monetary stimulus over the next five years. Central banks are beginning the task of increasing interest rates, albeit not to pre-2008 levels. However, while there are risks, we do not expect economic growth to stall. Indeed, we expect it to slow but remain above trend long-term growth over the next five years.

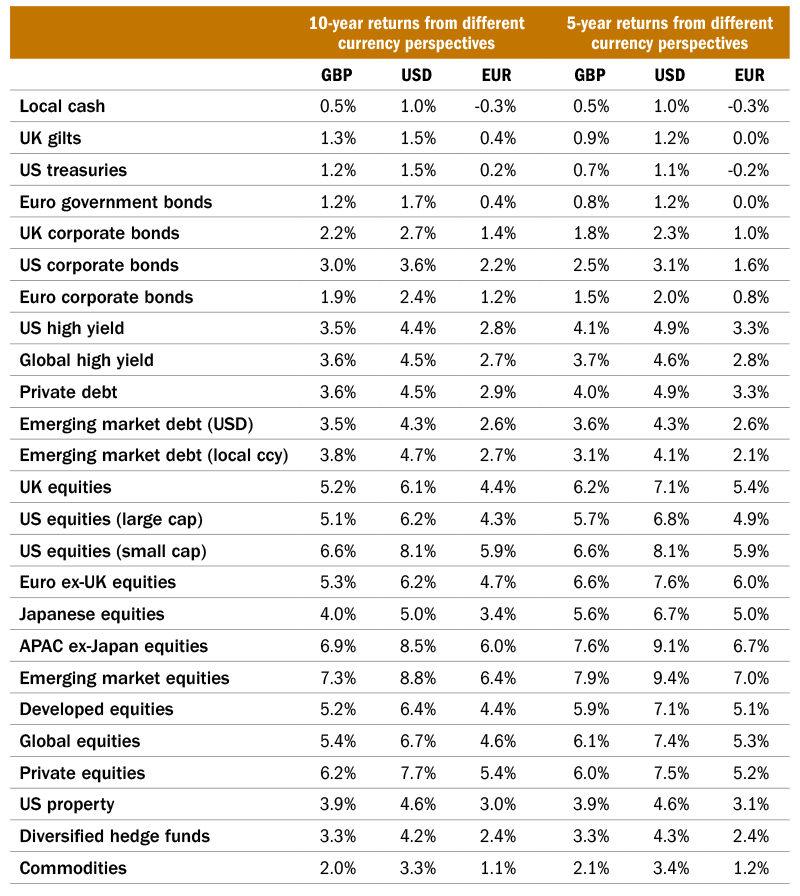

Rising yields necessarily have a significant impact on valuations of fixed income assets. While we believe government bonds should be most impacted, we expect credit to be buoyed by underlying economic growth. In equities, valuations are not yet stretched – especially outside of the US – when the low level of interest rates is taken into account.

The overall prospect for the next five years, therefore, is one in which we still see equities being attractive relative to long-run averages, especially in developed markets outside the US and in emerging markets. In contrast, we expect bonds, especially government bonds, to struggle as the long bull run in yields is replaced by a slow and steady uptick. Investors will therefore need to look beyond the usual places for diversification in this period. For this we continue to favour non-traditional markets such as property, infrastructure and private assets, which are partly driven by different risk premia such as illiquidity and where attractive valuations can still be found.

Potential risks

We expect steady rises in interest rates and economic growth to be stable, and while inflation may reach high levels it will settle back close to central bank targets. It is possible – though less likely, in our view – that inflation is not transitory and that banks then feel forced to take more robust action to rein-in prices. It would be easy in such a scenario for monetary policy to be too tough, and the result may be that economic growth is stifled.

Inflation rate (%)

Source: IMF, as at October 2021.

We view economic growth in the coming years as a global phenomenon, as countries resurface from pandemic-driven lockdowns and invest in a green transition to prevent severe global warming. Yet countries are working to their own timetables and take different approaches. While many western nations are relying on vaccinations to chart a path towards a world of living with Covid-19, China has to-date taken a notably different zero-tolerance approach. Broader policy divergence between the US and China, for example, could act as a brake on economic growth.

More generally, geopolitical tensions have the potential to disturb the smooth running of economies and markets. As well as US-China competition, the ongoing tensions between the UK and the EU or, more seriously between Russia and Ukraine or North and South Korea, are all capable of flaring up. The effects are difficult to predict, but we suggest holding a well-diversified portfolio and some US dollar exposure should help investors mitigate the worst portfolio impacts in these scenarios.

Summary

We expect the transition from falling yields to rising yields to be challenging for markets. We see good underlying growth prospects providing a tailwind to assets oriented to economic activity such as equities – and that these assets are not yet constrained by stretched valuations. However, we believe fixed income will no longer be the most natural balancer for portfolios biased towards these assets: government bonds will struggle in the coming years. In our view, alternative return sources linked to infrastructure, private assets and the green transition present more attractive diversification opportunities.

Our latest capital market assumptions

Arithmetic returns shown are in GBP, USD and EUR

Note that expected returns represent the average return of each asset class, excluding any contribution from stock selection where an investment or portfolio is managed actively. This is especially relevant when investing in private markets where the risks and returns related to the particular investment or manager can easily overshadow the market-related components. The specific characteristics of such investments therefore need to be given careful consideration.

Notes on index proxies used: UK gilts: FTSE Actuaries 5-15y Gilts; US treasuries: ICE BofAML 5-10y treasuries; Euro government bonds: Bloomberg Euro Government Bond 5-7yr Term Index; UK corporate bonds: iBoxx Sterling Non-Gilts 5-10y; US corporate bonds: ICEBofAML US Corporates; Euro corporate bonds: ICE BofAML Euro Non-Sovereign; US high yield: ICE BofAML US High Yield; Global high yield: Bloomberg Barclays Global high yield; Private debt: Preqin Private debt; Emerging market debt (USD): JPM Global EMBI; Emerging market debt (local ccy): JPM GBI-EM Global Diversified; UK equities: FTSE 100; US equities (large cap): S&P 500; US equities (small cap): Russell 2000; Euro ex-UK equities: MSCI Europe ex UK; Japanese equities: MSCI Japan; APAC ex-Japan equities: MSCI APAC ex Japan; Emerging market equities: MSCI emerging markets; Developed equities: MSCI World; Global equities: MSCI ACWI; Private equities: Preqin Private Equity; Commodities: Bloomberg Commodities total return. Bespoke proxies used for global infrastructure equities, US property and diversified hedge funds using BlackRock Aladdin.