People often say a crisis brings out the best and worst in people, and we have seen the same in companies. Mastercard has responded to the pandemic by committing to provide $250 million in small business support, mostly in the form of cyber vulnerability assessments and identity theft protection3 – two things that have become key as shops remain closed and retail moves online. Another example, this time not held in the portfolio, is Facebook whose Small Business Grants program will give more than $100 million to 30,000 small businesses across the globe.4

In another area of corporate life there is the question of dividends, which are close to investors’ hearts and now a matter of hot debate. Whose should be cut and by how much? The answer is not simple as pension schemes globally depend on dividend income to provide regular payments to retirees. Without these payments they could be forced to liquidate assets at a time when the market is reeling from the impacts of the pandemic, potentially threatening the system’s financial stability. On the other hand, companies whose revenues have been hit, and those such as banks who are systemically important and could use their cash to support vulnerable businesses, should focus their efforts in these areas. EssilorLuxottica, a leading producer of ophthalmic lenses and one of our holdings, has cut its dividend to protect its balance sheet after a tough quarter and finance a crisis fund for its employees, a move we fully support.

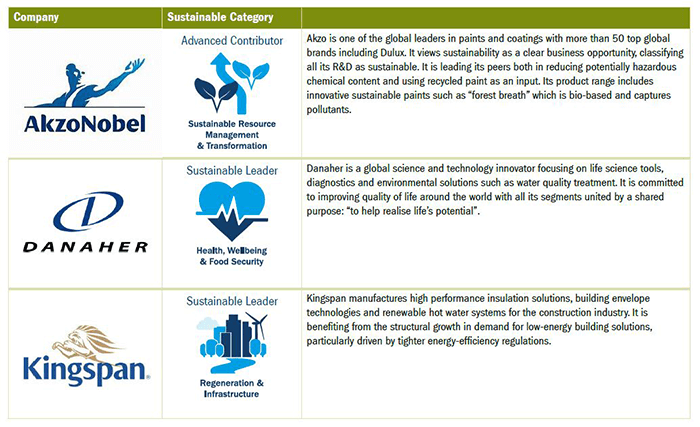

Company q120 sustainable impact highlights